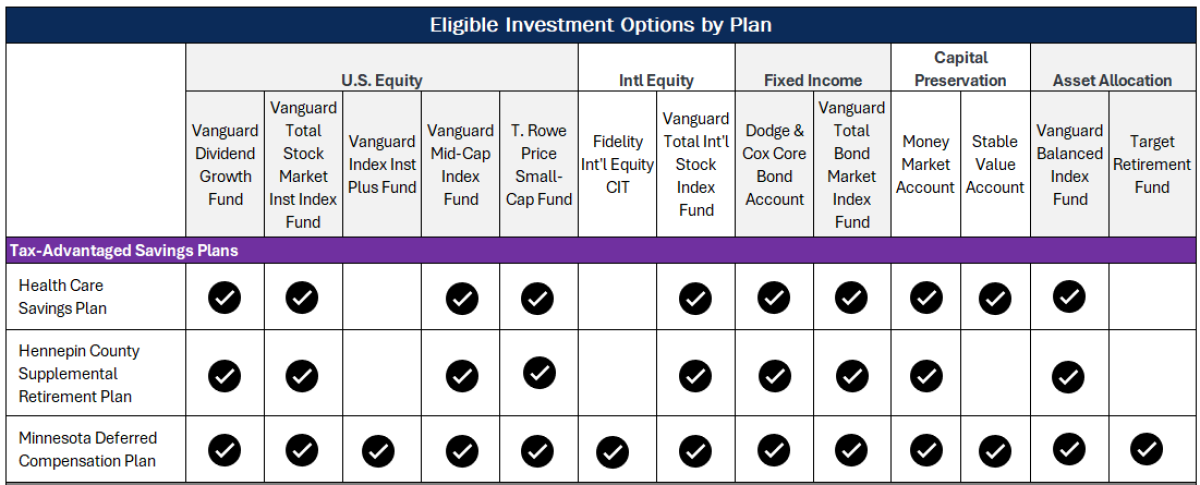

The SBI is responsible for providing investment options to various tax-advantaged savings plans. The SBI aims to help participants to meet their investment goals by offering a range of investment options across asset classes managed by institutional investment managers that charge competitive fees due to the SBI's scale. The investment options offered within each plan will vary based on several factors, including statutory requirements, operational limitations, and other rules and regulations established for each participating plan.

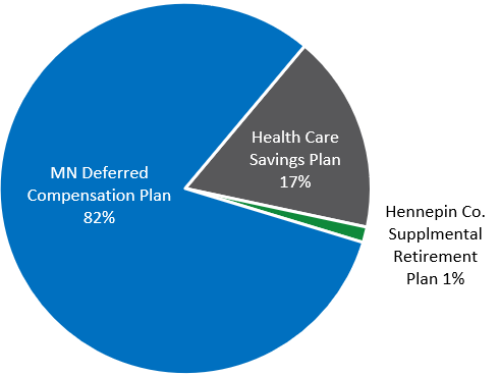

Tax-Advantaged Savings Plans - Participating Plans and Allocation of Assets as of June 30, 2025

- Health Care Savings Plan

- Hennepin County Supplemental Retirement Plan

- Minnesota Deferred Compensation Plan