The SBI manages the Non-Retirement Investment Program for designated trust funds, Other Postemployment Benefits (OPEB) trusts, Qualifying Governmental Entities and other programs created by the Minnesota Constitution and Legislature. The Non-Retirement Funds were established to provide eligible Minnesota public sector entities with the opportunity to invest in broad asset class options to aid them in achieving their investment objectives.

These trust funds and accounts have different accounting requirements and spending targets derived from constitutional and statutory provisions. Statute will also identify whether the SBI or the sponsoring entity is responsible for determining the asset allocation targets for the respective fund or account. To the extent possible, the SBI pools these assets for operating efficiencies and to reduce costs.

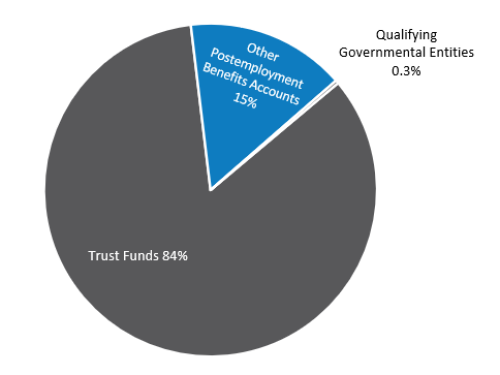

Non-Retirement Investment Program - Participating Plans and Allocation as of June 30, 2025

- Trusts and Other Participating Entities

- Other Postemployement Benefits (OPEB)

- Qualifying Governmental Entities

Fund Profiles

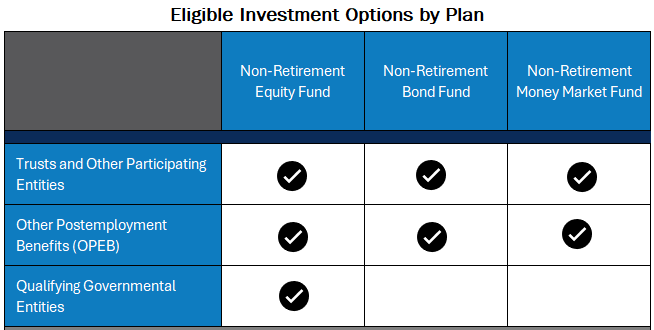

The Non-Retirement Equity Fund is passively managed to track the S&P 500 Index and is managed by Mellon Investments Corporation.

insert factsheet here

The Non-Retirement Bond Fund is actively managed to the Bloomberg U.S. Aggregate Bond Index by Prudential Global Investment Management.

insert factsheet here

The Non-Retirement Money Market Fund is managed by State Street Investment Management.

insert factsheet here