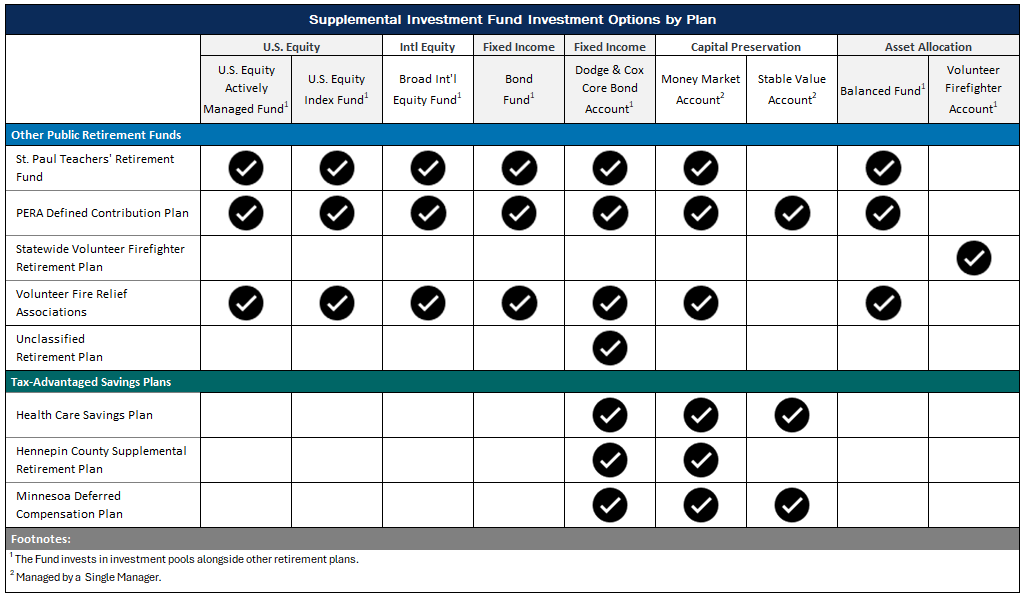

Established in Minnesota Statutes 11A.17, the Supplemental Investment Fund (SIF) is a multi-purpose investment platform that offers investment solutions to a variety of plans.

The Supplemental Investment Fund (SIF) platform provides a variety of investment options to help eligible participants meet their investment savings goals. Participating plans and individuals may allocate their assets among one or more of the options that are appropriate for their needs and are within the rules and eligibility established for the participating entity.

Add Intro sentence about factsheets

New Language: The fund aims to outperform the board U.S. equity market, as measured by the Russell 3000 Index. Its assets are held in a investment pool managed by external institutional managers, with oversight by the SBI.

Previous Language: The fund invests alongside the Combined Funds by investing the in the same asset class pools as the Domestic Equity Program. The actively managed strategies include investment managers benchmarked to various Russell styles, including large-cap growth and value, small-cap growth and value, and all-cap growth. The fund also invests in semi-passive investment managers benchmarked to a large-cap core style.

This fund invests in a passively managed Russell 3000 Index, which is a capitalization-weighted stock market index of the entire U.S. stock market.

The Fund invests alongside the Combined Funds by investing in the same asset class pools as the Combined Funds' International Equity Program. Active managers use a variety of investment styles and approaches as they seek to outperform the market. The Program's passive manager seeks to approximate the returns of the international markets in developed and emerging markets at a low cost. The Program's currency overlay program manager seeks to actively manage the portfolio's currency risk and provide a hedge against a decline in the value of the Fund's equity investments caused by currency fluctuations.

The Fund invests alongside the Combined Funds Core/Core Plus Bond segment. Investment managers in the core bond strategy invest in high-quality fixed income securities across all investment-grade sectors of the market. Managers in the core plus bond strategy invest in high-quality fixed income securities and are also allowed expanded flexibility to invest in high-yield corporate bonds, international securities, and bonds issued by emerging market sovereign and corporate issuers.

An actively managed account that invests primarily in investment-grade securities in the U.S. bond market, which is expected to outperform the Bloomberg U.S. Aggregate Index over time. The strategy opportunistically pursues areas the benchmark may not cover, such as below investment-grade debt, debt of non-U.S. issuers, and other structured products.

The Account seeks to provide safety of principal, a high level of liquidity and a competitive yield. The Account's return is based on the interest produced by the Account's investments. The Account performance is measured against the ICE BofA 3-Month Treasury Bill Index.

The Account seeks to preserve principal, maintain adequate liquidity to meet withdrawals, and generate a level of income consistent with a short- to intermediate-duration, high-quality fixed- income portfolio.

The Fund's long-term asset allocation is 60% in domestic equities, 35% in fixed income, and 5% cash. The domestic equity allocation invests in the U.S. Equity Index Fund, the fixed income allocation invests in the Bond Fund, and the cash allocation invests in the Money Market Account.

The Account's long-term asset allocation is 35% in domestic equities, 15% international equities, 55% in fixed income, and 5% in cash. The domestic equity allocation invests in the U.S. Equity Index Fund, the fixed income allocation invests in the Bond Fund, and the Cash segment invests in the Money Market Account.

The SBI publishes an Investment Prospectus(s) for the Supplemental Investment Fund and the Statewide Volunteer Firefighter Retirement (SVF) Plan, annually, after the end of the fiscal year.

The SIF Investment Prospectus provides performance, expenses, and other information regarding the investment options offered in the SIF Platform.

2025 Supplemental Investment Fund Investment Prospectus (PDF)

The SVF Plan Investment Prospectus provides performance, expenses, and other information regarding the Volunteer Firefighter Account. The SVF Plan is invested in a diversified account and is administered by Public Employees Retirement Association (PERA).

2025 Volunteer Firefigher Account Investment Fund Prospectus (PDF)